⚡ ADANI POWER STOCK SPLIT SPECIAL REPORT ⚡

🚀 Historic Milestone: Adani Power's First Stock Split

Adani Power Limited made history on Monday, September 22, 2025, as it implemented its first-ever stock split in a spectacular 1:5 ratio. This landmark corporate action has transformed each existing equity share with a face value of ₹10 into five shares with a face value of ₹2 each.

📊 Stock Split Mathematics

- Before Split: 100 shares × ₹10 = ₹1,000 total value

- After Split: 500 shares × ₹2 = ₹1,000 total value

- Result: 5X more shares, same investment value

📈 Market Reaction: Phenomenal 20% Surge

The market responded with unprecedented enthusiasm as Adani Power shares surged 20% to hit an intraday high of ₹170.25. The stock opened at ₹147.90 and quickly touched the upper circuit limit, demonstrating massive investor confidence.

🎯 Why Adani Power Split Its Stock

The company's board approved this strategic move with clear objectives to "facilitate greater participation from retail and small investors". This decision makes shares more accessible and affordable for individual investors.

✨ Key Benefits of Stock Split

🎪 Enhanced Liquidity

Increased trading volume and better price discovery

👥 Retail Participation

Lower price point attracts small investors

📊 Outstanding Shares Transformation

The stock split dramatically increased the company's outstanding shares from 385.69 crore to over 1,928 crore shares. This massive expansion enhances market liquidity while maintaining the same market capitalization.

🔄 Share Structure Changes

| Metric | Before Split | After Split |

|---|---|---|

| Face Value | ₹10 | ₹2 |

| Outstanding Shares | 385.69 crore | 1,928+ crore |

| Share Ratio | 1 | 5 |

🌟 SEBI Clearance Boosts Confidence

The stock split comes at a perfect time as the Securities and Exchange Board of India (SEBI) cleared the Adani Group of stock manipulation allegations made by Hindenburg Research. This regulatory relief has significantly boosted investor confidence.

⚖️ SEBI's Key Findings

- ✅ No evidence of stock price manipulation

- ✅ No violations of related-party transactions

- ✅ Dismissed all claims by Hindenburg Research

- ✅ Concluded investigation with clean chit

🎯 Morgan Stanley's Bullish Target: ₹818

Global brokerage Morgan Stanley has initiated coverage on Adani Power with an "Overweight" rating and a target price of ₹818, representing nearly 30% upside potential from current levels. The brokerage describes Adani Power as India's largest private coal-based independent power producer.

🚀 Growth Projections

- Current Capacity: 18.15 GW operational capacity

- Future Target: 41.9 GW by FY32

- Market Share Growth: From 8% to 15% in coal-based capacity

- Investment Plan: $22-27 billion in under-construction projects

💰 Strong Financial Performance

Adani Power reported robust Q1 FY26 earnings with consolidated net profit of ₹8,759 crore, up 83% from the previous year. The company's strong financial foundation supports its ambitious expansion plans.

⚡ Future Growth Catalysts

Adani Power is positioned to benefit from India's growing power demand driven by data centers, urbanization, and rising temperatures. The company's strategic expansion aligns perfectly with India's energy requirements.

🎪 Key Growth Drivers

📊 Market Demand

6% CAGR in peak power demand expected

🏗️ Capacity Addition

Limited capacity addition creates opportunities

🌱 Green Energy

14.2 GW to 50 GW renewable capacity by FY30

💼 Investment Plan

$60 billion investment in power sector by FY32

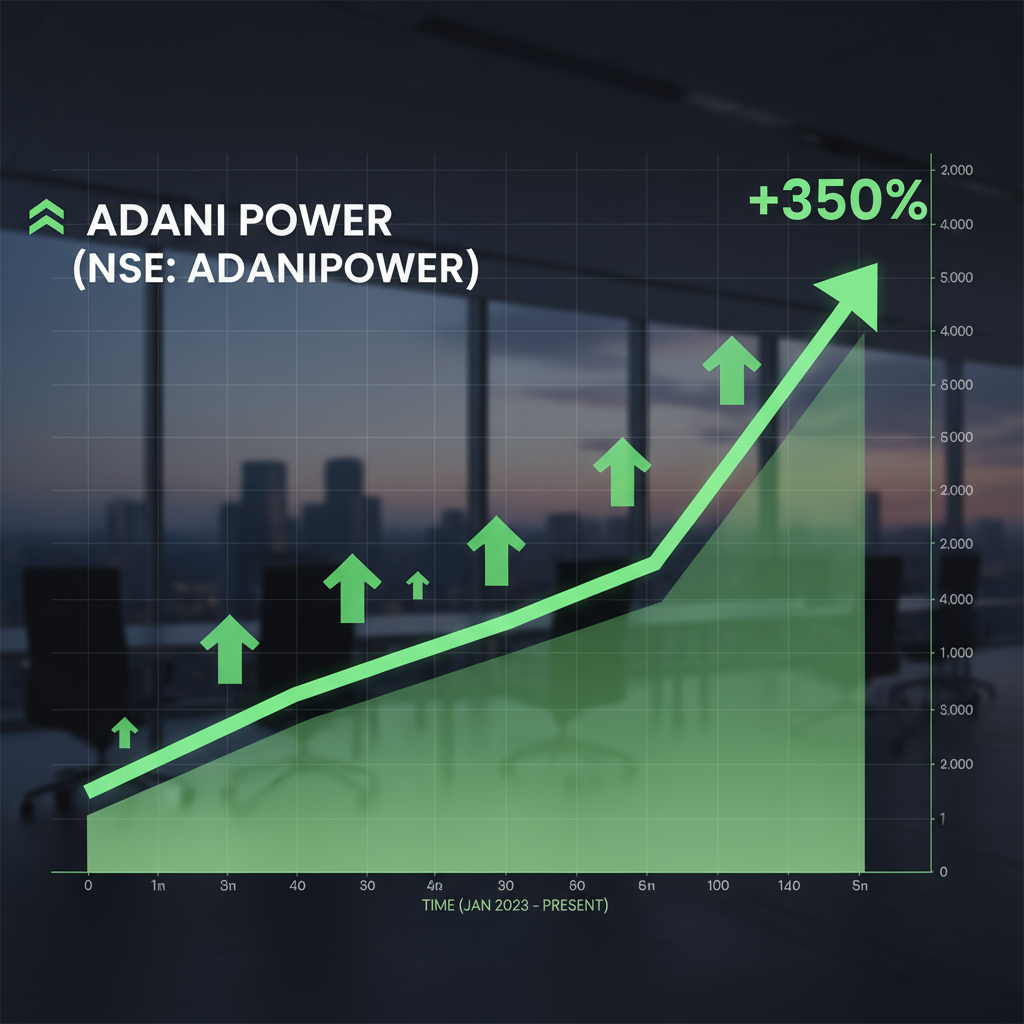

📈 Stock Performance Highlights

Adani Power has delivered exceptional returns to investors with remarkable performance across different time periods. The stock has shown consistent growth momentum, making it a favorite among both retail and institutional investors.

📊 Return Analysis

| Time Period | Returns |

|---|---|

| Past 1 Week | +7.29% |

| Past 3 Months | +60.54% |

| Past 1 Year | +26.67% |

| Past 5 Years | +2219.48% |

⚠️ Important Investor Notes

📋 Key Information

- Record Date: September 22, 2025 - Shareholders must hold shares in demat accounts

- Eligibility: Only existing shareholders as of record date receive split benefits

- Market Cap: ₹273,611.25 crore as of current trading

- Sector: Utilities - Power Generation

⚠️ Investment Disclaimer: This article is for informational purposes only. Stock investments carry risks and past performance doesn't guarantee future returns. Please consult your financial advisor before making investment decisions.

🎯 The Bottom Line

Adani Power's historic stock split marks a new chapter of growth and accessibility for retail investors. With SEBI clearance, strong financial performance, and ambitious expansion plans, the company is well-positioned to capitalize on India's growing power demand.

The stock split democratizes ownership while maintaining the same intrinsic value - a win-win for existing and new investors alike!

📊 Stay updated with latest market news and investment insights

Last Updated: September 22, 2025 | Source: Live Market Data