Income Tax Portal & ITR Filing 2025: Complete Guide to incometax.gov.in

🚨 Breaking News: ITR Filing Deadline Today!

Last Date: September 15, 2025 - No Extension Announced

The Income Tax Department has confirmed that there is no further extension to the ITR filing deadline for AY 2025-26. Over 7 crore ITRs have already been filed.

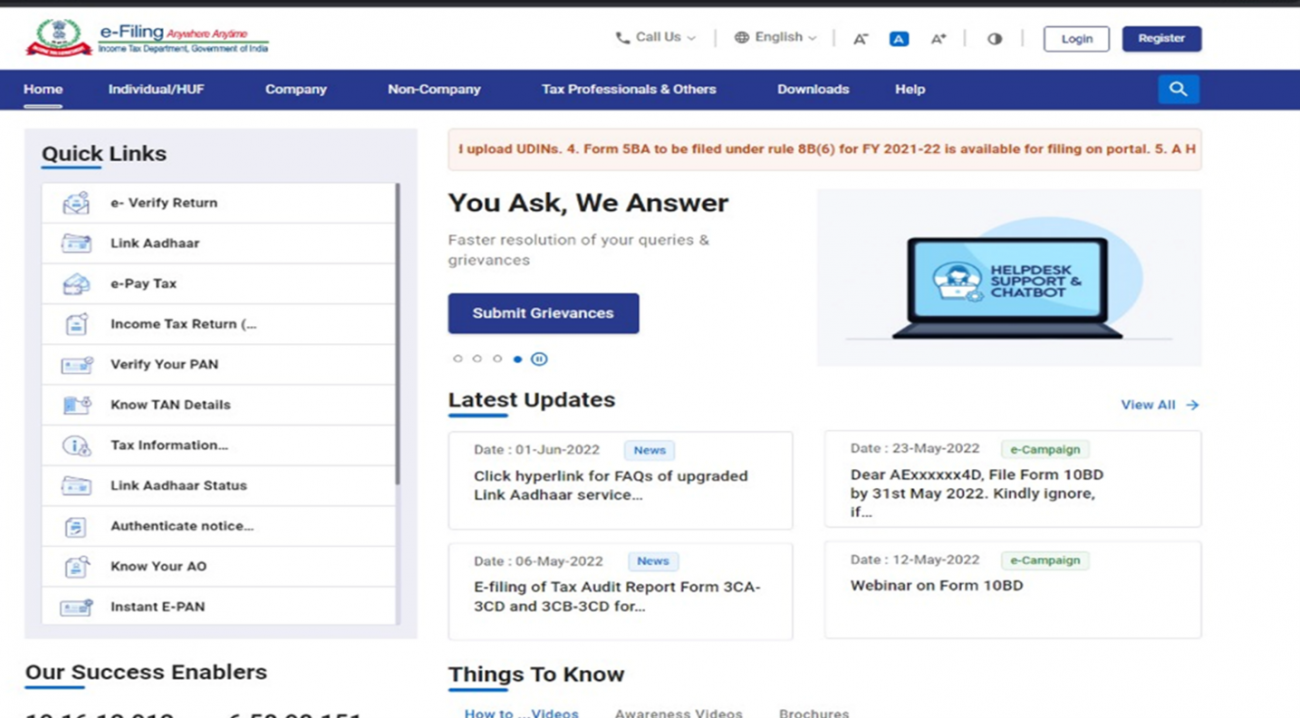

Official Income Tax e-Filing Portal - incometax.gov.in

Income Tax Portal: Your Gateway to Digital Tax Filing

The Income Tax Portal (incometax.gov.in) serves as the primary digital platform for all tax-related services in India. With over 7 crore taxpayers using the portal for ITR filing in 2025, it has become the backbone of India's digital tax infrastructure.

🎯 Quick Access Links

- Main Portal: www.incometax.gov.in

- E-Filing Portal: eportal.incometax.gov.in

- Tax Calculator: Available under Quick Links

- Refund Status: Check via portal login

ITR Filing Last Date & Extension Updates 2025

⚠️ Critical Deadline Information

Original Due Date: July 31, 2025

Extended Due Date: September 15, 2025

Final Status: No further extension announced by CBDT

Assessment Year 2025-26 Filing Deadlines

| Taxpayer Category | Due Date | Applicable Forms |

|---|---|---|

| Non-Audit Cases (Individuals, HUFs) | September 15, 2025 | ITR-1 to ITR-4 |

| Audit Cases | October 31, 2025 | All ITR Forms |

| Transfer Pricing Report | November 30, 2025 | Specific Forms |

E-Filing ITR: Step-by-Step Process

Complete ITR E-Filing Process Flow

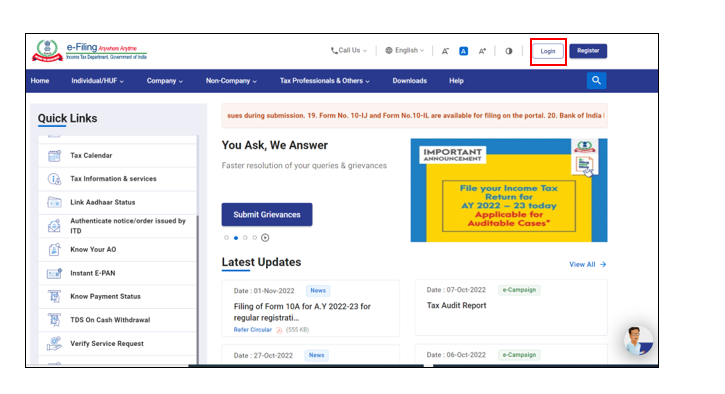

Step 1: Login to Income Tax Portal

- Visit www.incometax.gov.in

- Click on "Login" button

- Enter PAN as User ID and Password

- Complete captcha verification

Step 2: Navigate to ITR Filing

- Go to "e-File" menu

- Select "Income Tax Return"

- Choose "File Income Tax Return"

- Select Assessment Year 2025-26

Step 3: Select Appropriate ITR Form

- ITR-1 (SAHAJ): Salary, pension, house property income up to ₹50 lakh

- ITR-2: Individuals/HUFs without business income

- ITR-3: Individuals/HUFs with business/professional income

- ITR-4 (SUGAM): Presumptive taxation scheme

Step 4: Fill Return Details

- Review pre-filled information from Form 26AS

- Add additional income sources

- Claim eligible deductions

- Calculate tax liability

Step 5: Submit and E-Verify

- Preview your return carefully

- Submit the return

- E-verify using Aadhaar OTP, Net Banking, or Bank Account

- Download acknowledgment receipt

Income Tax Portal Login Issues & Solutions

🔧 Portal Not Working? Try These Solutions

Many users faced issues on September 15, 2025 due to heavy traffic. The IT Department recommends:

- Clear Browser Cache: Delete temporary files and cookies

- Use Supported Browsers: Chrome 88+, Edge 88+, Firefox 86+

- Try Incognito Mode: Ctrl+Shift+N (Chrome/Edge)

- Disable Extensions: Turn off ad-blockers and privacy tools

- Switch Networks: Try different Wi-Fi or mobile hotspot

- Contact Support: Email orm@cpc.incometax.gov.in or call 1800-103-4215

E-Pay Tax: Online Tax Payment Methods

Secure Online Tax Payment Options

The Income Tax Portal provides multiple convenient payment methods through its e-Pay Tax service:

Available Payment Modes

- Net Banking: All major banks supported

- Debit/Credit Cards: Visa, MasterCard, RuPay

- UPI Payments: Quick and secure

- RTGS/NEFT: Direct bank transfer

💡 Pro Tip: Pre-Login vs Post-Login Payment

You can pay taxes even without logging in! Use the "e-Pay Tax" option on the homepage for quick payments. However, logging in provides better tracking and integration with your tax records.

Income Tax Calculator 2025

Online Income Tax Calculator - Compare Old vs New Regime

The built-in Income Tax Calculator on incometax.gov.in helps taxpayers compute their tax liability accurately:

Calculator Features

- Basic Calculator: Quick computation with income and deduction inputs

- Advanced Calculator: Detailed calculation with all income heads

- Regime Comparison: Compare tax under old vs new tax regime

- Real-time Updates: Reflects latest tax slabs and rates

ITR Return Forms & Filing Options

| ITR Form | Applicability | Income Limit | Filing Mode |

|---|---|---|---|

| ITR-1 (SAHAJ) | Salary, Pension, House Property | Up to ₹50 Lakh | Online/Offline |

| ITR-2 | Individuals without Business Income | No Limit | Online/Offline |

| ITR-3 | Business/Professional Income | No Limit | Online/Offline |

| ITR-4 (SUGAM) | Presumptive Taxation | Up to ₹50 Lakh | Online/Offline |

ITR Refund Status Check

Track Your Income Tax Refund Status Online

Checking your ITR refund status is simple through the Income Tax Portal:

How to Check Refund Status

- Login to incometax.gov.in

- Go to "e-File" → "Income Tax Returns"

- Select "View Filed Returns"

- Click "View Details" for the relevant assessment year

- Check refund status in the return details

📊 Refund Processing Timeline

- Simple Returns: Processed within hours (New Regime)

- Regular Returns: 4-5 weeks after e-verification

- Complex Returns: May take longer due to verification requirements

Late Filing Penalties & Consequences

💰 Penalty Structure for Late Filing

Section 234F Penalty:

- Income above ₹5 lakh: ₹5,000 penalty

- Income below ₹5 lakh: ₹1,000 penalty

Section 234A Interest:

- 1% per month on unpaid tax from due date

- Calculated till the date of payment

Additional Consequences of Missing Deadline

- Loss Carry Forward: Cannot carry forward capital losses

- Refund Delays: Processing may take longer

- Scrutiny Risk: Higher chances of tax department notices

- Compliance Issues: Impacts credit score and loan applications

Income Tax Department Services

The Income Tax Department provides comprehensive online services through its portal:

Core Services Available

- ITR Filing: Online return submission for all forms

- Tax Payment: e-Pay tax with multiple payment options

- Refund Management: Track and reissue refunds

- PAN Services: Apply for new PAN, corrections, and linking

- TDS Services: TDS return filing and certificate download

- Compliance Management: Notice responses and rectification requests

Technical Support & Help

📞 24x7 Support Available

The Income Tax Department provides round-the-clock support during peak filing periods:

- Helpline: 1800-103-4215

- Email Support: orm@cpc.incometax.gov.in

- Live Chat: Available on portal

- WebEx Sessions: Screen sharing support

Future of Income Tax Portal

The Income Tax Department continues to enhance its digital infrastructure:

Recent Improvements

- Pre-filled Returns: Auto-populate salary and TDS details

- Aadhaar Integration: Seamless verification process

- Mobile Responsiveness: Optimized for smartphones and tablets

- API Integration: Better data exchange with third-party services

- Enhanced Security: Multi-factor authentication and encryption

🔮 What's Coming Next?

The Income Tax Department is working on:

- AI-powered return processing

- Blockchain-based verification systems

- Enhanced mobile applications

- Real-time tax computation

- Integrated financial data ecosystem

Conclusion: Master Your Tax Filing in 2025

The Income Tax Portal has revolutionized tax filing in India, making it more accessible and efficient for crores of taxpayers. With the September 15, 2025 deadline being the final date for AY 2025-26, it's crucial to complete your ITR filing immediately.

🎯 Key Takeaways

- Always file your ITR before the due date to avoid penalties

- Use the official incometax.gov.in portal for all tax-related services

- Keep your documents ready and use pre-filled information wisely

- E-verify your return within 30 days of filing

- Contact official support channels for any technical issues

Remember, timely ITR filing is not just about compliance – it's about building a strong financial profile that helps in loan approvals, visa applications, and various other financial services. Stay updated with the latest guidelines and make the most of India's digital tax infrastructure.