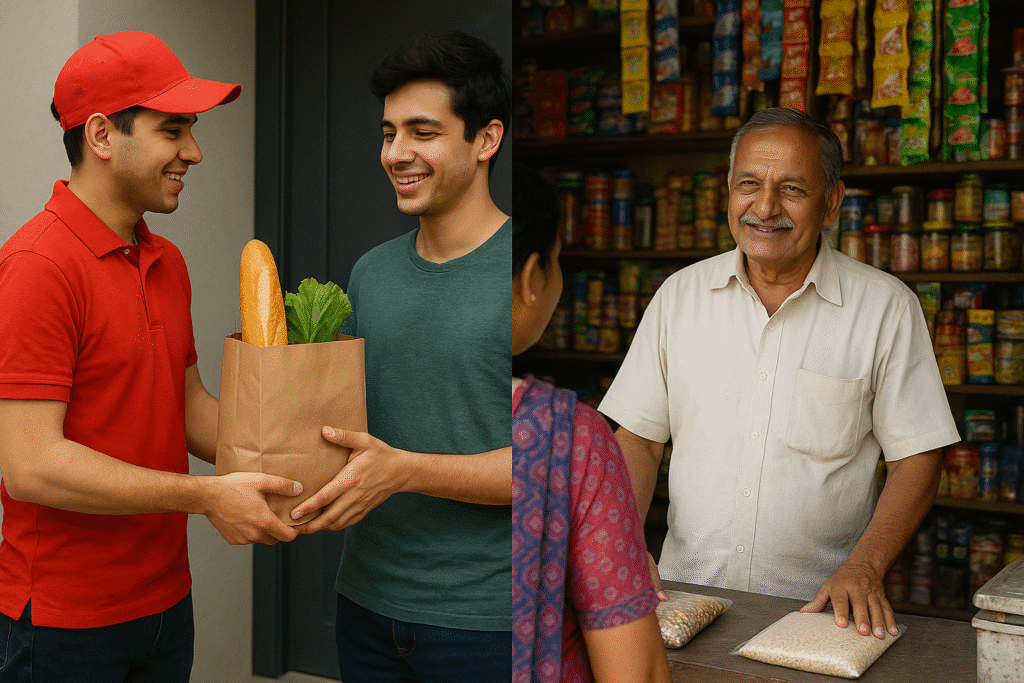

Quick Commerce is Rocking – So Are Kirana Stores on the Way Out?

India’s retail landscape is undergoing a transformative phase, with the explosive rise of quick commerce redefining how urban consumers shop for daily essentials. From groceries to snacks to toiletries, platforms like Blinkit, Zepto, and Swiggy Instamart are promising deliveries in just 10 to 30 minutes, riding on the back of technology, hyperlocal warehousing, and changing consumer expectations.

But amidst all the hype and convenience, one pressing question lingers:

Are India’s traditional kirana stores—those beloved neighborhood shops—facing extinction?

Let’s dive deeper into what’s really happening on the ground.

The Meteoric Rise of Quick Commerce

Quick commerce (Q-commerce) is a retail model built around ultra-fast delivery of small quantities of goods. While e-commerce in India took over a decade to evolve, Q-commerce has exploded within just a few years.

Why is it booming?

Convenience: Urban professionals, especially millennials and Gen Z, are often short on time. Being able to get milk, bread, or even ice cream delivered in 10 minutes is incredibly appealing.

Smartphone Penetration: India’s growing digital ecosystem—with affordable data, mobile apps, and UPI payments—has made it easier than ever to place orders.

Massive Investment: Startups in this space have attracted billions in funding. These platforms are running on large losses but focusing on customer acquisition and market dominance.

Promotional Offers: From discounts to cashback, quick commerce companies are aggressively wooing customers.

The concept is especially thriving in metro cities like Delhi, Mumbai, Bengaluru, and Hyderabad, where speed trumps everything.

What About Kirana Stores? Are They Losing the Battle?

On the surface, it may seem like kirana stores are slowly being pushed out. After all, why would someone walk to a corner shop if they can get everything delivered to their doorstep in minutes?

But that’s only one side of the story.

The Unbeatable Strengths of Kiranas

Despite the digital storm, kirana stores continue to thrive for several reasons:

Personal Connection: Kirana shopkeepers often know their customers by name. This personal relationship builds trust and loyalty.

Credit Facility (Udhaar): Many kiranas offer informal credit to long-time customers—a service quick commerce cannot replicate.

No Minimum Order: Whether someone wants a ₹5 packet of chips or a single sachet of shampoo, kiranas serve with a smile and without delivery conditions.

Hyperlocal Understanding: Kirana owners deeply understand local demand. They stock what their specific community wants.

Adaptability: Many kiranas have already started adapting to digital trends by joining platforms like JioMart, Udaan, or using apps like Khatabook, Dukaan, and even WhatsApp for orders.

The Reality: It’s Not Either-Or, It’s Coexistence

The idea that quick commerce will eliminate kirana stores is oversimplified.

In reality, both models cater to different segments and different needs:

A young urbanite might use Zepto for a midnight snack.

A middle-aged homemaker might still rely on her trusted kirana for daily rationing.

In small towns, where Q-commerce hasn’t yet penetrated, kiranas are still kings.

Also, Q-commerce platforms themselves rely on dark stores (small local warehouses), and in some cases, even partner with kiranas for fulfillment. This shows that instead of replacing, there’s potential for collaboration.

Challenges Facing Quick Commerce

While quick commerce is exciting, it’s not without its problems:

Sustainability Concerns: Most Q-commerce platforms are not profitable. Delivering small items at high speed often leads to high operational costs.

Workforce Exploitation: The pressure to deliver in 10 minutes has raised concerns about rider safety and fair labor conditions.

Waste Generation: Ultra-fast delivery often leads to excessive packaging, which impacts the environment.

Limited Reach: So far, Q-commerce is largely limited to urban Tier 1 cities. India’s retail market is massive, and kiranas still dominate Tier 2, Tier 3 towns, and rural areas.

The Kirana Revolution: Going Digital

Interestingly, the kirana ecosystem is also undergoing its own transformation.

Thanks to startups and fintech platforms, many kiranas are:

Going online with their inventory.

Accepting digital payments via UPI and QR codes.

Using POS systems to track sales and stock.

Partnering with e-commerce platforms to fulfill online orders.

This digitization wave is making kirana stores more efficient and competitive.

Future Trends: What’s Likely to Happen?

Looking ahead, India’s retail sector will not be a winner-takes-all game. Here’s what we can expect:

Hybrid Models: Kiranas may continue adopting technology and partner with delivery apps to stay relevant.

Segmented Market: Quick commerce will dominate in high-income urban neighborhoods, while kiranas will continue to flourish in lower-income and semi-urban areas.

Policy Support: The Indian government has also launched initiatives to digitize small retailers, which may further boost kirana competitiveness.

Customer Behavior Diversification: Consumers will likely use both models depending on convenience, pricing, and need.

Final Thoughts: The Real Winner is the Indian Consumer

Whether it’s quick commerce or kirana stores, one thing is clear: the Indian consumer stands to benefit the most. With more options, faster deliveries, and competitive pricing, shopping has never been easier.

Instead of replacing kirana stores, the rise of Q-commerce might just redefine them—making them smarter, faster, and more connected.

So, are kiranas on the way out?

Absolutely not. They are here to stay—just in a more evolved form.